Everything You Need to Know About Cash Flow Forecasting

Maintaining a healthy cash flow is crucial to survival and growth in business management. Imagine peering into your company's financial crystal ball, foreseeing cash flow, and heading toward prosperity. The magic lies in the art of cash flow forecasting.

What is cash flow forecasting?

Cash flow forecasting is gathering an estimate of a company’s future financial position. Your cash flow forecast is based on anticipated payables and receivables. You need to estimate your future sales and expenses to forecast your cash flow. This will help you understand how your business will do financially in the coming months.

What Are The Benefits of Cash Flow Forecast?

A cash flow forecast is crucial for any business. It tells you if you’ll have the needed revenue to run or expand the business. It also allows you to see if more cash is going out of the company than in and identify the problem areas so you can reverse that cash drain.

How to forecast your cash flow

1. Identify your forecasting objectives

First, determine the business objectives the forecast will support. This will help you glean actionable insights from your cash flow forecast. We’ve rounded up the most commonly used cash forecasts for the following five goals:

- Growth planning. It ensures your business has enough working capital to fund activities and projects. This will help grow your company’s revenue.

- Liquidity risk management. It fosters visibility for potential issues that may arise in the future. For example, more cash going out of your business than in. This gives you adequate time to address them.

- Interest and debt reduction. Debt can be an unavoidable fact of running a business. If your goal is to reduce interest and debt, your cash flow forecast will help ensure your business has enough money to make loan or debt payments.

- Short-term liquidity planning. Make sure your business can meet its short-term obligations by managing the amount of cash available daily.

- Covenant and key date visibility. This best forecasts your cash levels for critical reporting periods. These include year-end, quarter-end, and month-end.

2. Choose your forecasting period

You have now identified which business objective your cash flow forecast will support. The next step is to determine how far into the future your forecast will look. Choosing the proper reporting period can impact your forecast's accuracy and reliability. As a general rule, the further into the future your forecast looks, the less detailed it’s likely to be. Here are the four most common forecasting periods and the objectives they’re most suitable for:

- Short-term forecasts. These are best suited for short-term liquidity planning. Day-to-day granularity is crucial to your business’s financial responsibilities. They usually look two to four weeks into the future and include a daily breakdown of payments and receipts.

- Medium-term forecasts. These typically look two to six months into the future. They are extremely helpful for interest and debt reduction, key date visibility, and managing liquidity risk. Most companies utilizing a medium-term projection use the rolling 13-week cash flow forecast.

- Long-term forecasts. Looking six to twelve months ahead, long-term forecasts are often the starting point for annual budgeting. A long-term forecast is essential for assessing how much cash is needed for long-term growth objectives and projects. It's also necessary to know the required cash.

- Mixed-term forecasts. These are most commonly used for liquidity risk management. They utilize a mix of the three periods mentioned above. For example, a mixed-term forecast might provide weekly forecasts for the first three months. It might also offer monthly forecasts for the following six months.

3. Decide on a forecasting method

Your chosen method depends on the forecasting window and the data available to build your forecasting model. There are two main cash flow forecasting methods: direct and indirect. Direct forecasting uses actual flow data and is best utilized for short-term forecasts. Indirect forecasting is better suited for long-term forecasting. It relies on projected balance sheets and income statements.

4. Gather the data you need for your cash flow forecast

The final step before implementing your forecast is gathering the required data. You can find most, if not all, of the data needed in your AR and AP ledgers. You can see it directly in your business's ERP or other accounting software. You’ll want to gather the following information from those systems:

- Opening cash balance for the forecasting period

- Cash inflows for the forecasting period

- Cash outflows for the forecasting period

With this data and the proper forecasting method, you can accurately forecast your business’s cash flow. You can also identify problem areas and plan for the future.

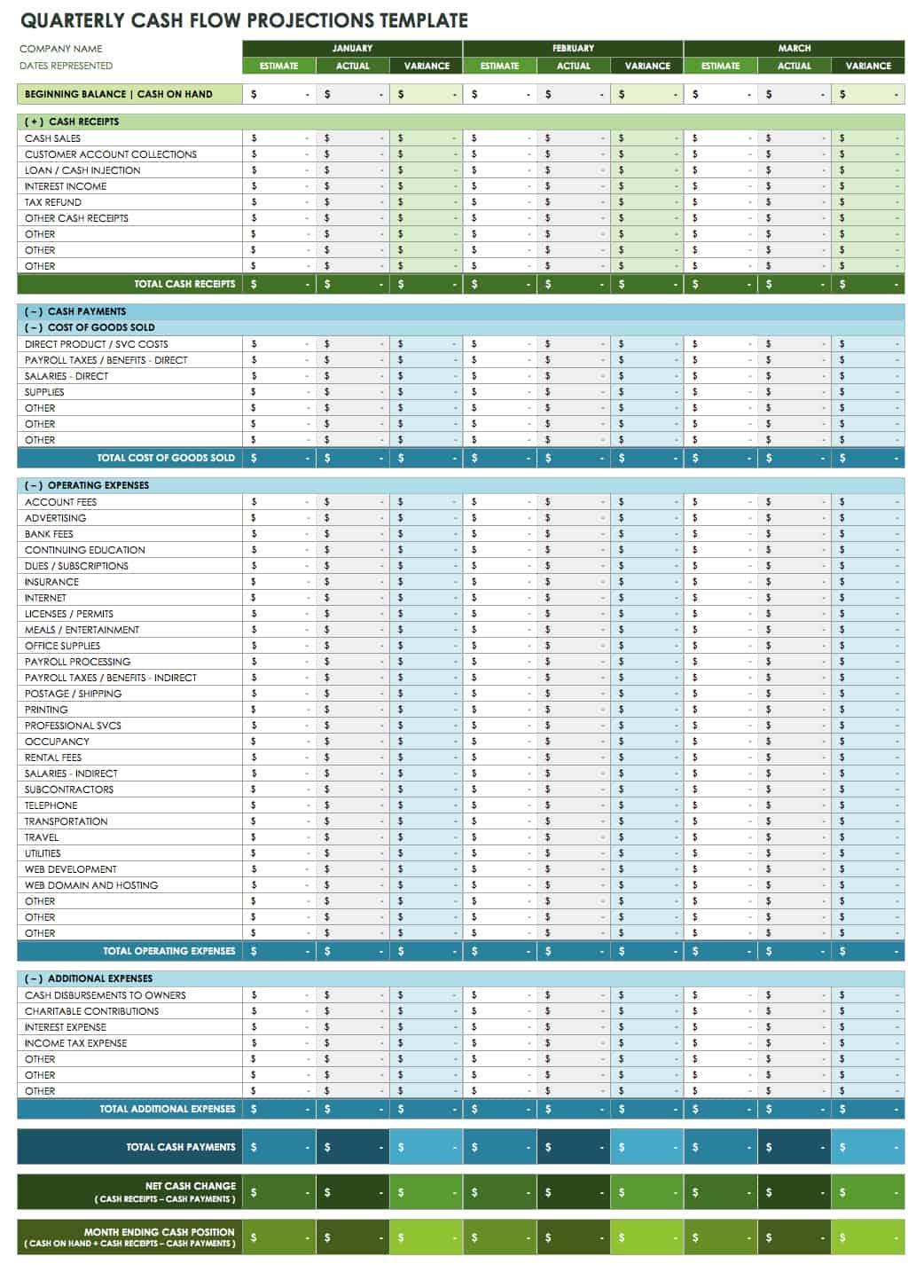

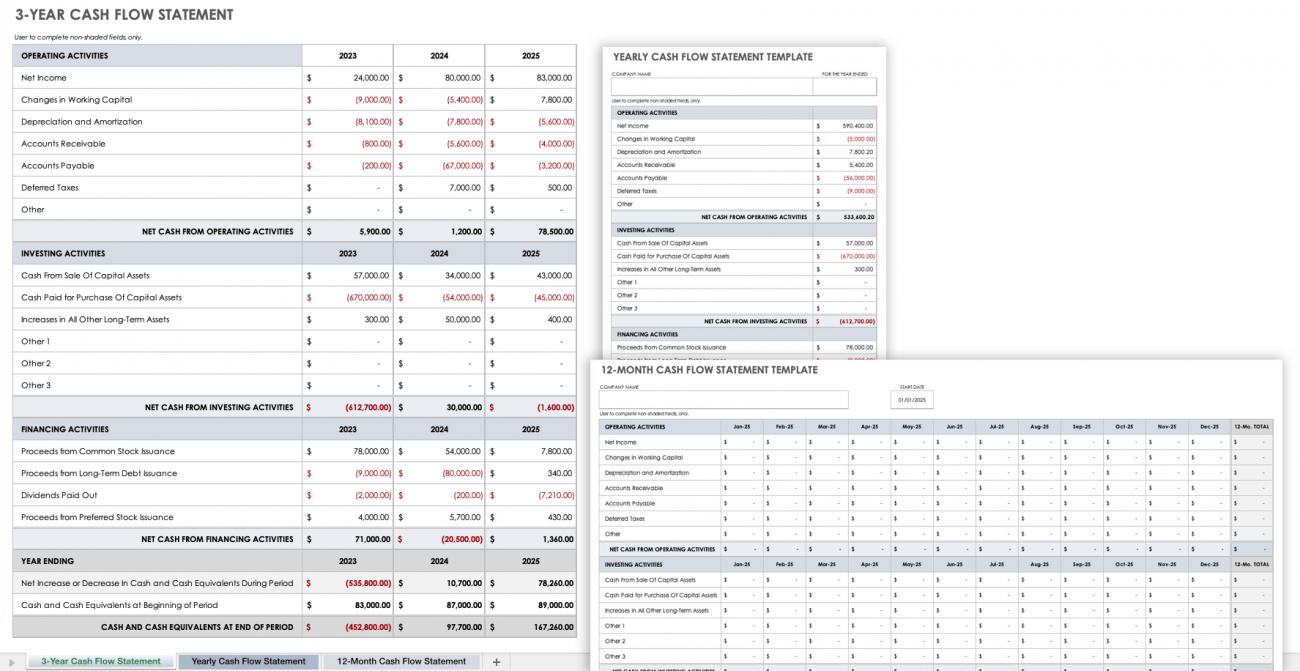

Not sure where to start or which forecasting method suits your business? We’ve gathered a few of our favorite templates to help you get started:

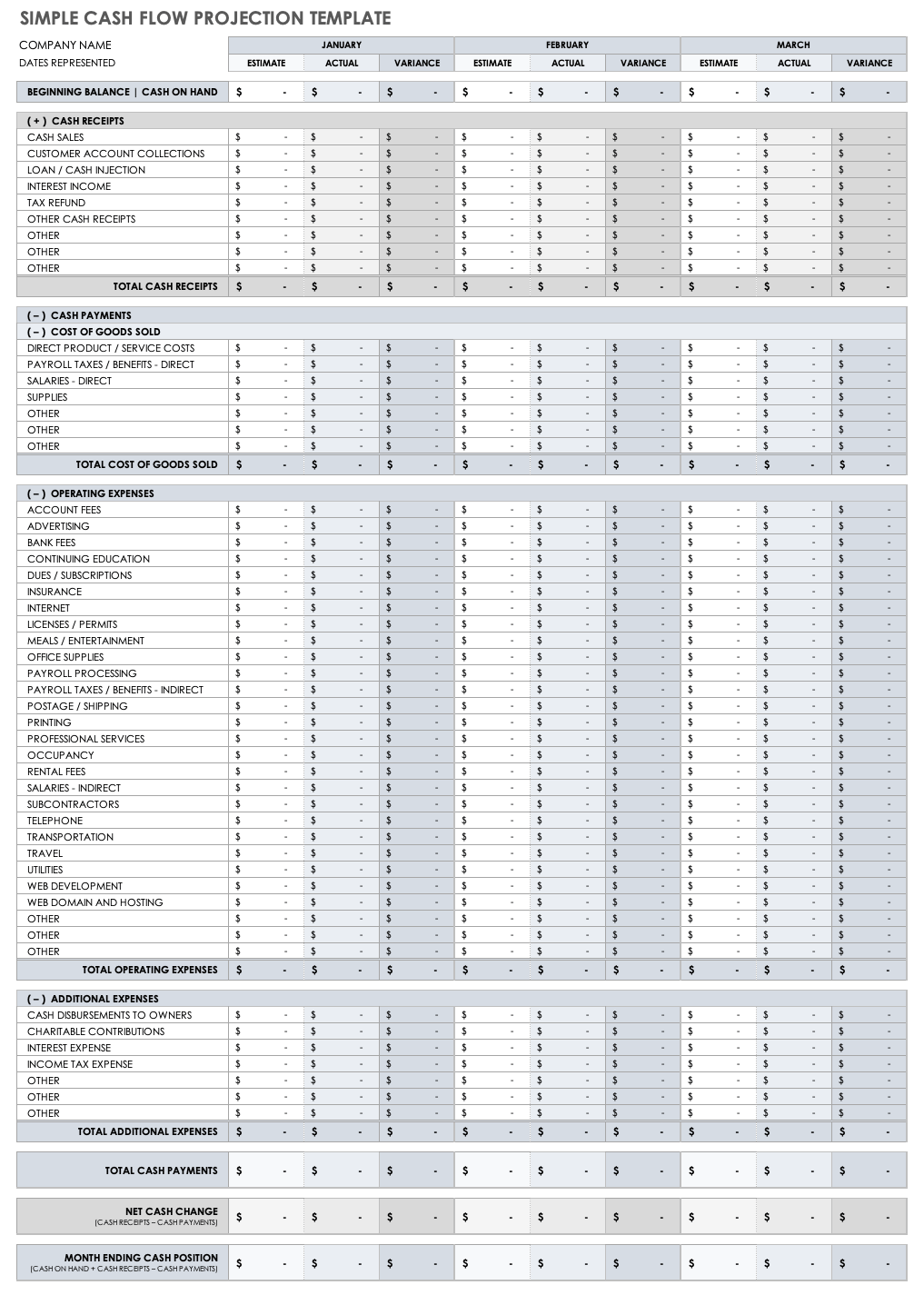

Simple Cash Flow Forecast Template

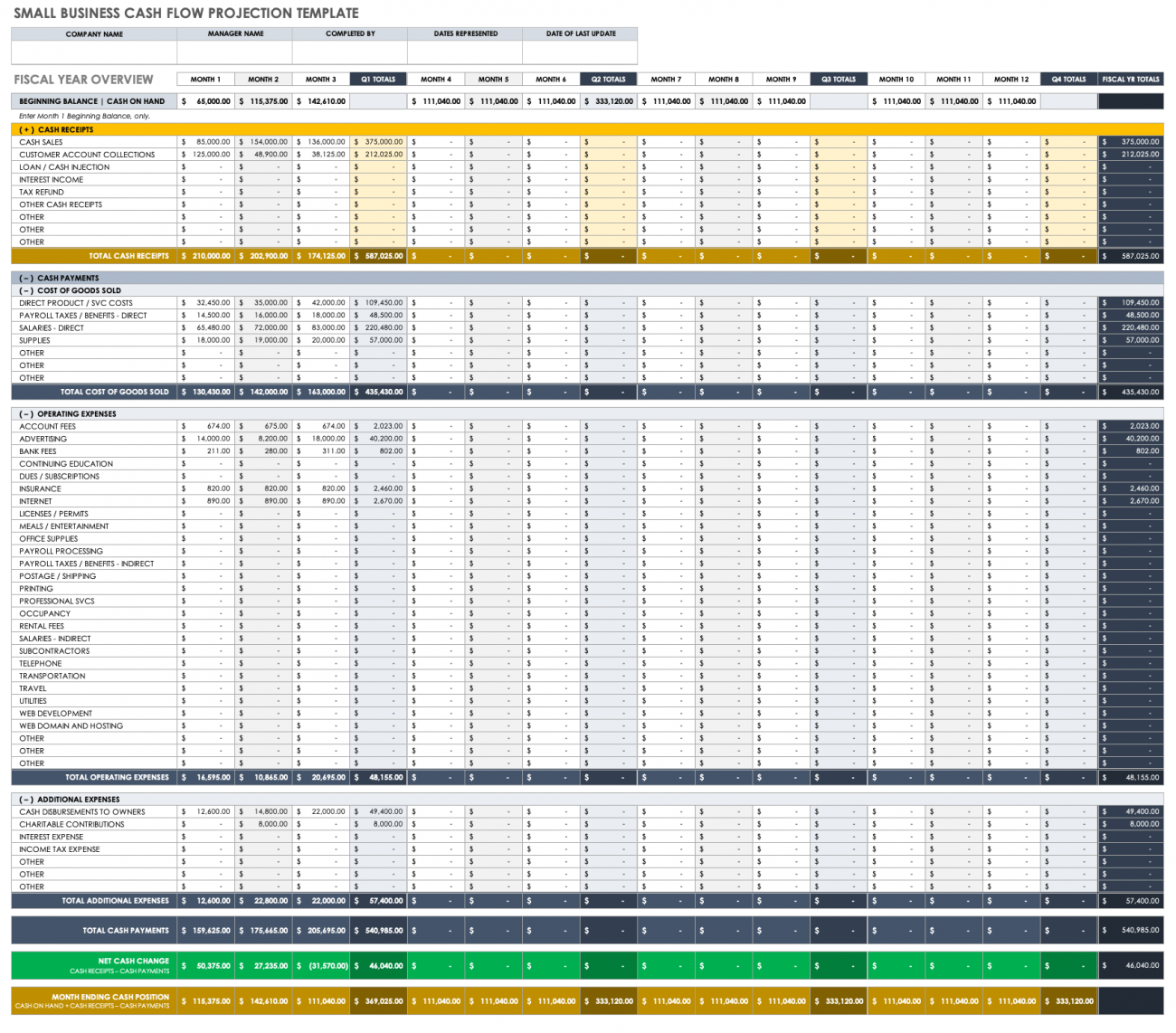

Small Business Cash Flow Forecast Template

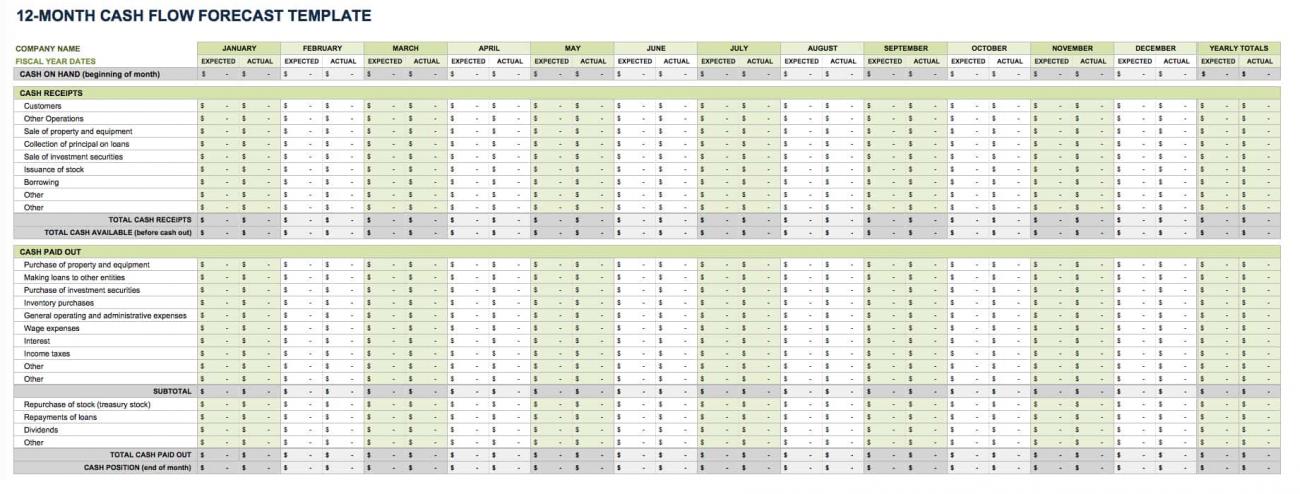

12-Month Cash Flow Forecast Template

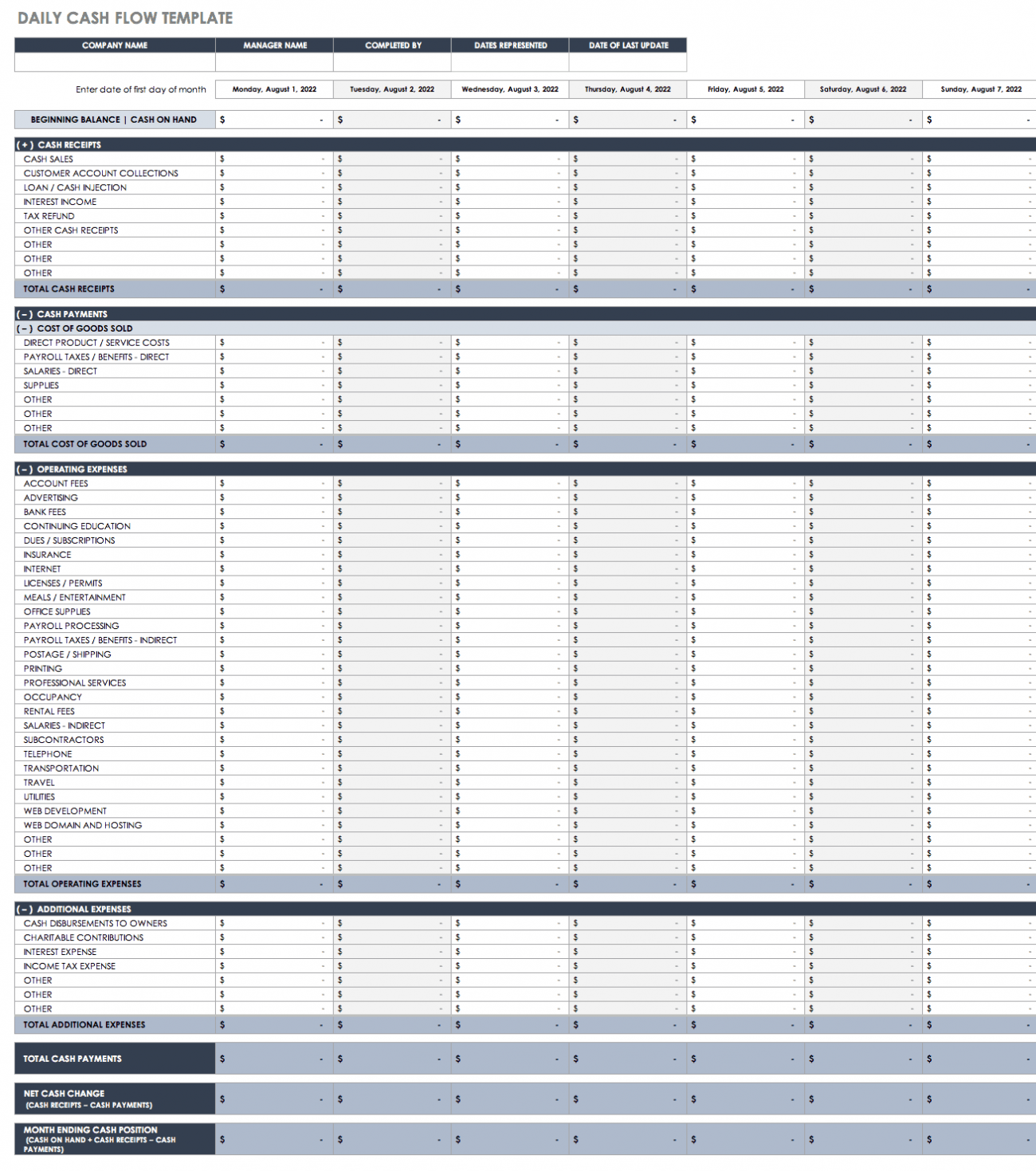

Daily Cash Flow Forecast Template

Quarterly Cash Flow Forecast Template

Three-Year Cash Flow Forecast Template

Ready to learn more? Paystand’s Improving Cash Flow learning path has a wealth of resources that will help you reduce your DSO and improve operating cash flow.

1800 Green Hills Road

1800 Green Hills Road Av Adolfo López Mateos Nte 95

Av Adolfo López Mateos Nte 95